Unify your data, unleash your firm's AI

A purpose-built dealmaking platform for private equity that plugs into your tech stack, unifying market and proprietary data to enable AI agents to quickly source deals and provide context for each investment thesis.

A selection of our clients

The firm's data ecosystem, in one intelligent engine.

Integrate all internal and external data sources into a living, learning data engine built to optimize dealmaking and drive sustained competitive advantage for your firm.

Helping tech leadership get data in the fast lane

Our purpose-built data engine pulls together your entire market and proprietary data ecosystem, fueling your AI roadmap.

Agentic AI for PE, from origination to value creation

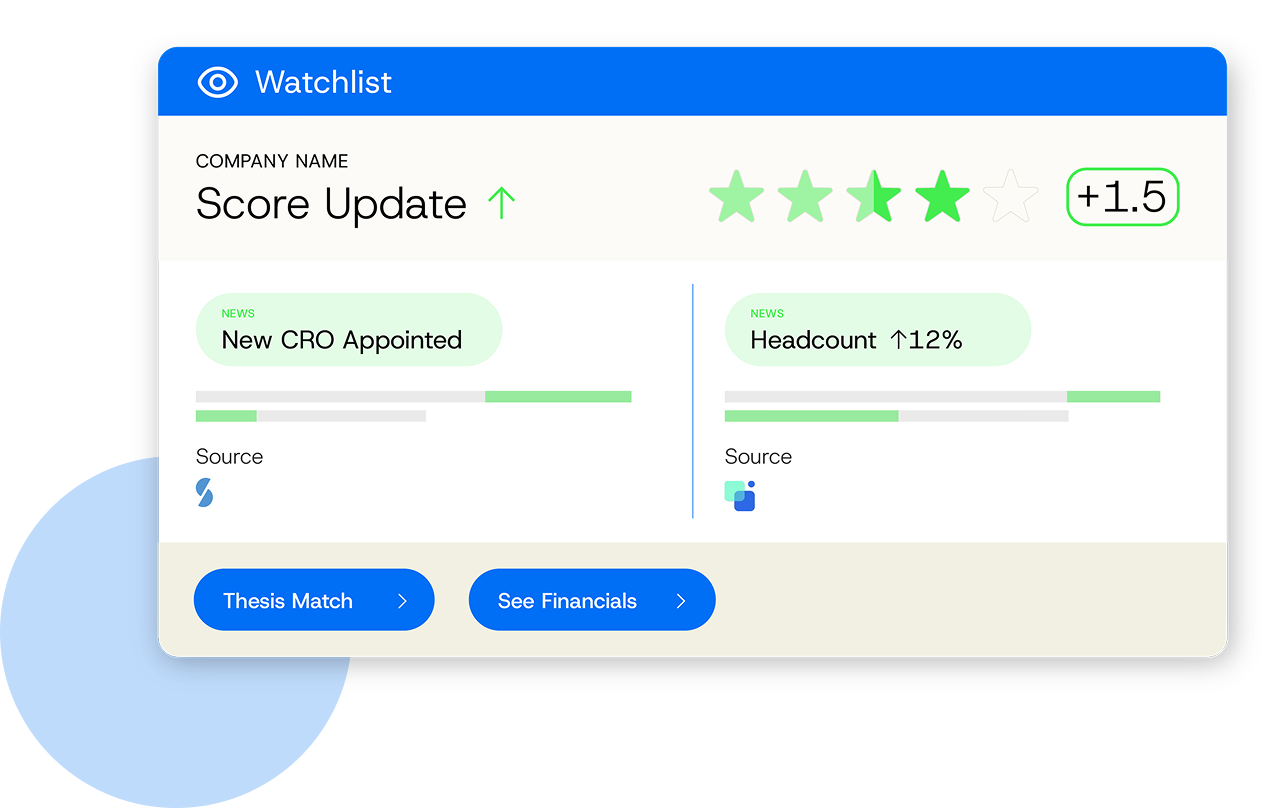

Empower origination teams with codified scoring, net-new recommendations, watchlists and tracked deals.

Connecting the unconnected in dealmaking

Unifying the data, intelligence, and signals that exist for private equity firms, and transforming it into deals.

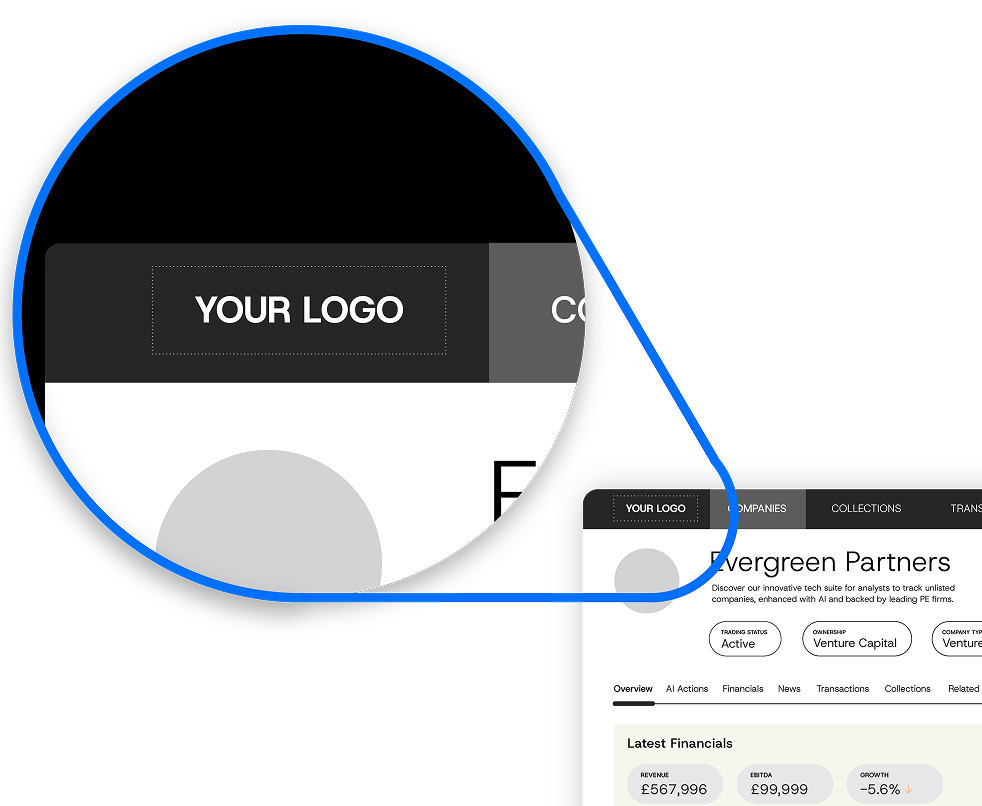

Finally, a platform your firm can truly customize

Deal Engine is offered as a white-labelled solution, resulting in faster onboarding, adoption, brand alignment and organizational buy-in.

Find more net new deals for your firm

Codify your strategy, track the market and increase relevance. Deal Engine delivers always-on agentic AI intelligence that continuously monitors your entire investable universe — specified by your thesis — and surfaces high-fit targets.

Unify data, unlock insights

White-label the technology and make your Deal Engine entirely yours. Deal Engine brings together proprietary, third-party, and public data into a single connected layer, transforming information into actionable intelligence.

Power up instead of piling on

Optimize your data spend and unlock the value in your CRM and internal documents. Deal Engine enriches your CRM with structured, intelligent data without adding clutter, complimenting your existing tech stack instead of complicating it.

Build the gen AI-enabled firm of tomorrow

Fuel your AI roadmap with an integrated agentic AI intelligence layer. Accumulate and train your firm’s own proprietary dealmaking engine, built to evolve with your strategy and scale firm-wide tech-readiness.

Enabling firms to create their own edge

45M+

datapoints accumulated in a typical deployment

161

actionable insights per firm per month, on average

64

new deals on the radar in 2 months, on average

99.5%

decreased analyst time spent on manual research

.png)

ToltIQ and Deal Engine Announce Partnership to Connect Deal Sourcing and Due Diligence Platforms

NEW YORK and LONDON – Feb. 12, 2026 ToltIQ, the leading AI-powered platformfor private equity due diligence, and Deal Engine, the market monitoring data engine forprivate markets, today announced a strategic partnership that connects deal originationwith diligence execution for private equity firms, corporate M&A teams, and familyoffices The partnership enables firms to carry critical market and deal intelligence seamlesslyacross the deal lifecycle. Deal teams typically rely on fragmented tool stacks that createloss of context, rework, and delays as deals progress. By bringing Deal Engine'ssourcing and market intelligence into ToltIQ's diligence environment, the partnershipaddresses that challenge, allowing firms to maintain continuity from earliest pipelinedevelopment through final investment decisions. "When building your dealmaking architecture, Deal Engine gets you from idea to dataroom and ToltIQ takes you from NDA through confirmatory diligence," said Ed Brandman, CEO of ToltIQ. "Investment teams don't need disconnected tools that forcethem to re-enter context at each stage. This partnership recognizes that the intelligenceyou gather during origination should inform your diligence approach, and the patternsyou see in diligence should refine your sourcing criteria." "Private market firms need a joined-up data architecture," said Phil Westcott, CEO ofDeal Engine. "This partnership connects a firm’s market deal intelligence and executioninsights to support the full journey from idea to investment committee decision, helpingteams apply what they already know, earlier and more effectively." Beginning in March 2026, Deal Engine can be deployed alongside the ToltIQ platform,allowing Tolt IQ users to benefit from live market intelligence and context during thediligence and execution process. Users gain the ability to track live market context on each target, their competitors, suppliers, and customers, enriching the formal diligence processes. As companiesmove under NDA and enter data rooms, teams gain immediate access to outside-in market intelligence alongside internal documents, supporting accelerated ramp-up,more targeted analysis, and stronger investment committee narratives. For Deal Engine customers, the ToltIQ integration enables firms to extend theirknowledge integration architecture deeper into the deal cycle, benefitting from ToltIQ’s market leading application of AI to streamline the diligence process. The partnership enables firms to: Reduce diligence ramp-up time by starting with market context alreadygathered during pre-deal execution sourcing and market monitoring Apply lessons learned in diligence back to sourcing criteria without manualdata transfer Maintain consistent competitive intelligence from initial target identificationthrough the confirmatory diligence process "Deal Engine and ToltIQ have each built strong positions in their respective workflowstages," said Rick Kushel, Managing Partner at FINTOP Capital. "As a shared investor,we believe this integration creates additional value for firms looking to reduce frictionacross the deal lifecycle while maintaining distinct strengths at each phase." About ToltIQ ToltIQ is the leading provider of AI-powered private market due diligence solutions for GPs, LPs, diligenceadvisory firms and Family Offices. By combining advanced artificial intelligence with deep private marketsexpertise, ToltIQ helps investment professionals conduct more thorough, efficient, and accurate duediligence. The company's platform securely ingests deal documents typically found in virtual data roomswhile rapidly analyzing and categorizing them to extract critical insights. By delivering clear, actionableintelligence and reducing the need for manual workflows, ToltIQ enables investment teams to focus onwhat drives deal value - from growth opportunities and early detection of risks to operational improvements. ToltIQ was founded by Ed Brandman, former Partner, Chief Information Officer and Headof Credit Operations at global investment firm Kohlberg Kravis Roberts & Co. (KKR). For more informationor to schedule a demo, please visitToltIQ.comandLinkedIn. About Deal Engine (formerly Filament Syfter) Deal Engine is the first and only leading dealmaking data engine provider, purpose-built for privatemarkets dealmakers. This new technology enables firms to centralize, enrich, and institutionalize market,proprietary and public data. Increase dealmaker efficacy, improve resource allocation, enhance relationships, and originate the best-fit deals across platform investments and a firm’s portfolio with DealEngine. To schedule a demo, visitdealengine.tech. About FINTOP Capital FINTOP Capital is a venture capital firm focused on early-stage fintech companies. With over $700 million in committed capital across five funds, FINTOP brings decades of fintech founding and operatingexperience to the boardroom, partnering with innovative entrepreneurs to push the frontiers of thefinancial services sector. For more information, visitwww.fintopcapital.com. Get your demo now to see how this works in practice.

Too many tools, and not enough deals - where's the ROI?

How UI fatigue is quietly killing momentum in private equity By Alex Bajdechi, VP of Sales, Deal Engine Everyone is trying to get AI into their business. Across private equity, there is growing pressure to adopt AI. Firms are continuing to experiment with LLM’s, automation tools, and agents, often with the expectation that these technologies will unlock efficiency, insight, and competitive advantage. The focus, however, is frequently on deploying the latest capability rather than addressing the conditions required for it to work effectively.In many cases, AI is being layered onto environments where data remains fragmented across CRMs, sourcing platforms, market data tools, document libraries, internal models, and bespoke systems. Without integration, consistency, and reliable data flows, AI does not clarify decision-making. It amplifies uncertainty. Models trained on incomplete, conflicting, or poorly governed data struggle to produce outputs that deal teams trust or act on. This creates a paradox. AI is intended to reduce inefficiency, yet when introduced without first consolidating systems and data, it can compound the very problems it is meant to solve. Time is still lost moving between tools, reconciling information, and validating outputs. Adoption suffers, confidence erodes, and opportunities are missed. The result is not transformation, but fatigue, at a point when firms are under more pressure than ever to move quickly and decisively. Over the last decade, private equity firms have made significant investments in technology and data. CRMs, deal sourcing platforms, market intelligence tools, portfolio analytics, expert networks, and bespoke internal systems have all become part of the modern deal team’s toolkit. Individually, many of these tools are valuable. Collectively, they have created a new problem: UI fatigue. Today’s dealmakers spend an increasing amount of time toggling between platforms. Logging in and out, cross-referencing screens, reconciling conflicting data points, and trying to remember where a particular insight came from. What was meant to increase efficiency has, in many cases, had the opposite effect. More tools, less time for actual dealmaking Every additional platform adds cognitive overhead. Instead of spending time building relationships, travelling to meet business owners, or deepening ties with intermediaries and investment banks, deal professionals are stuck stitching together fragmented views of the same opportunity. The issue is not a lack of intelligence. Firms are better informed than ever. The issue is that intelligence is scattered across too many interfaces, each with its own assumptions, data models, and definitions of truth. As more products and data sources are layered in, it becomes harder, not easier, to answer basic questions. Which data do we trust? What has already been reviewed internally? Where should attention be focused right now? Trust and alignment do not scale across dozens of platforms UI fatigue also creates misalignment inside the firm. Different teams rely on different tools. Different partners trust different datasets. Notes live in one system, scores in another, and decisions somewhere else entirely. When that happens, confidence erodes. Deal teams second-guess the data, hesitate to act, or duplicate work that has already been done. The cost is not just time. It is momentum. Why consolidation is now a strategic imperative At this stage of the market’s maturity, the answer is not adding yet another point solution. It is consolidation. Firms need a single environment where intelligence is unified, validated, and presented through operating models specific to how their firm makes decisions. That means fewer screens, fewer signals, and far less noise. The goal should be intentional reduction. By design, a dealmaker should have less to look at, not more. Less toggling. Less deciphering. Less ambiguity. How Deal Engine addresses UI fatigue by design This is where Deal Engine fits. Deal Engine is the conncective tissue, bringing together your internal data and external structured and unstructured data to create a clean single source of truth that powers your LLMs of choice. The technology applies firm-specific data validation rules and workflows so that only relevant, trusted information rises to the surface - saving the dealmaker days of research and sourcing time. Instead of forcing deal teams to reconcile conflicting signals across tools, the platform does that work upstream. The result is clarity. Dealmakers see what matters, understand why it matters, and can move forward with confidence, without drowning in interfaces. After a decade of tech proliferation, private equity does not need more dashboards. It needs fewer, better ones. Deal Engine helps firms get there, so deal teams can spend less time managing software and more time doing what they do best: finding, building, and closing great investments. Get your demo now to see how this works in practice.

The dealmaker blueprint: five ways to build decision ready origination data

In association with RealDeals, this article was published first on the RealDeals website. The dealmaker blueprint: five ways to build decision-ready origination data As private markets mature and AI adoption accelerates, origination data must be decision-ready. These five principles show how teams are building clarity, consistency and conviction at the point of judgement. Judgement, timing, and confidence in private markets dealmaking increasingly hinge on one thing: whether origination data is decision-ready before pressure mounts. As AI becomes more prevalent, many private equity and corporate finance firms are discovering an uncomfortable truth – advanced tooling cannot compensate for weak data foundations. When data is fragmented, inconsistent, or context-poor, hesitation can begin to surface precisely when conviction matters most. This has shifted the conversation away from AI experimentation and toward a more fundamental imperative: disciplined data engineering. The most sophisticated deal teams, working closely with technology leadership, are focused on building a long-term competitive edge while retaining room for experimentation. At the same time, they are laying the data foundations that support dealmaking today and position the firm to capitalise on advances in foundational LLMs in the years ahead. Below are five principles shaping how firms are turning origination data into decision-ready intelligence, based on emerging best practices across the market and the experience of Deal Engine (formerly Filament Syfter) supporting early adopters. 1. Clarity over completeness The instinct to collect and deploy AI against every datapoint at the firm remains strong, but volume rarely translates to insight. Decision-ready data is selective by design, structured around the specific questions deal teams need answered, not the maximum amount of information that can be gathered. High-performing origination functions often focus on relevance: which deal dynamics consistently influence prioritisation and conviction. By curating data models around decision drivers rather than exhaustive detail, teams can reduce noise and accelerate judgement. Clarity also enables faster pattern recognition, ensuring that, when a deal surfaces, teams can interpret signals instead of wading through excess. 2. Context at the point of judgement Data without context risks misinterpretation for dealmakers. Origination decisions are comparative and directional, shaped by prior activity and market signals rather than single data points. Decision-ready data situates opportunities within historical performance, market movement and competitive dynamics, linking what is happening now to what has happened before across sectors, counterparties, and comparable deal types. When context is embedded into origination workflows, teams avoid over-weighting isolated signals. Judgement is anchored in a broader narrative, with information framed against historical patterns and market dynamics rather than viewed in isolation. 3. Consistency across opportunities Inconsistent data structures can undermine decision-making. When deals are assessed against shifting baselines, with different definitions, levels of depth, or ad hoc metrics, comparisons stand to lose reliability. Firms investing in consistent origination frameworks are able to confidently establish common data standards across deals, sectors, and regions. This preserves nuance while ensuring that differences reflect real performance rather than structural inconsistencies. Consistency allows teams to trust comparisons, align internally, and build conviction without having to question the integrity of the data itself. 4. Reliability under pressure The true test of origination data comes late in the deal lifecycle. As competition intensifies and timelines compress, weak foundations surface through last-minute reconciliation, data gaps and uncertainty. By contrast, decision-ready data is built to hold up under pressure, remaining dependable as scrutiny increases rather than only during early exploration. This helps to reduce redundant work, prevent stalled momentum, and preserve confidence when the stakes are highest. Increasingly, reliability is about predictability across teams. Each function within a private equity or corporate finance firm should understand what the data can and cannot support, and make decisions accordingly. 5. AI as an enhancer, not a substitute AI delivers value only once foundations are stable. Without structured, contextualised data, AI amplifies inconsistency rather than insight. Leading firms treat AI as a layer applied after core data disciplines are in place – to surface patterns, accelerate synthesis, and support judgement, not replace it. When applied to decision-ready data, AI enhances speed and depth without undermining trust. When applied prematurely, it introduces opacity and risk. Building for judgement first The firms extracting real value from AI are those that first invested in disciplined origination data. As deal teams reassess how data supports judgement at the point of decision, the focus is shifting to building foundations that hold up under pressure, well before AI enters the equation. Deal Engine works with origination teams to design these data foundations, informed by how early adopters are structuring decision-ready workflows. Get your demo now to see how this works in practice. Originally published in collaboration with RealDeals - see the original article on the RealDeals website.

Leading European PE firm adopts Deal Engine for deal prioritization

Leading pan-European mid-market private equity firm with $12bn+ in assets under management begins onboarding Deal Engine to strengthen early-stage sourcing, prioritization and AI readiness.

Be first to every deal.

See Deal Engine in action.

Discover how Deal Engine is providing private equity firms with the data engineering and AI capabilities fueling their competitive advantage.