Unify your data, unleash your firm's AI

A software platform purpose-built for Private Equity, that plugs into your existing tech stack; unifying market, publicly available & proprietary data into a bespoke dealmaking engine.

A selection of our clients

The firm's data ecosystem, in one intelligent engine.

Integrate all internal and external data sources into a living, learning data engine built to optimize dealmaking and drive sustained competitive advantage for your firm.

Helping tech leadership get data in the fast lane

Our purpose-built data engine pulls together your entire market and proprietary data ecosystem, fueling your AI roadmap.

AI for PE, from origination to value creation

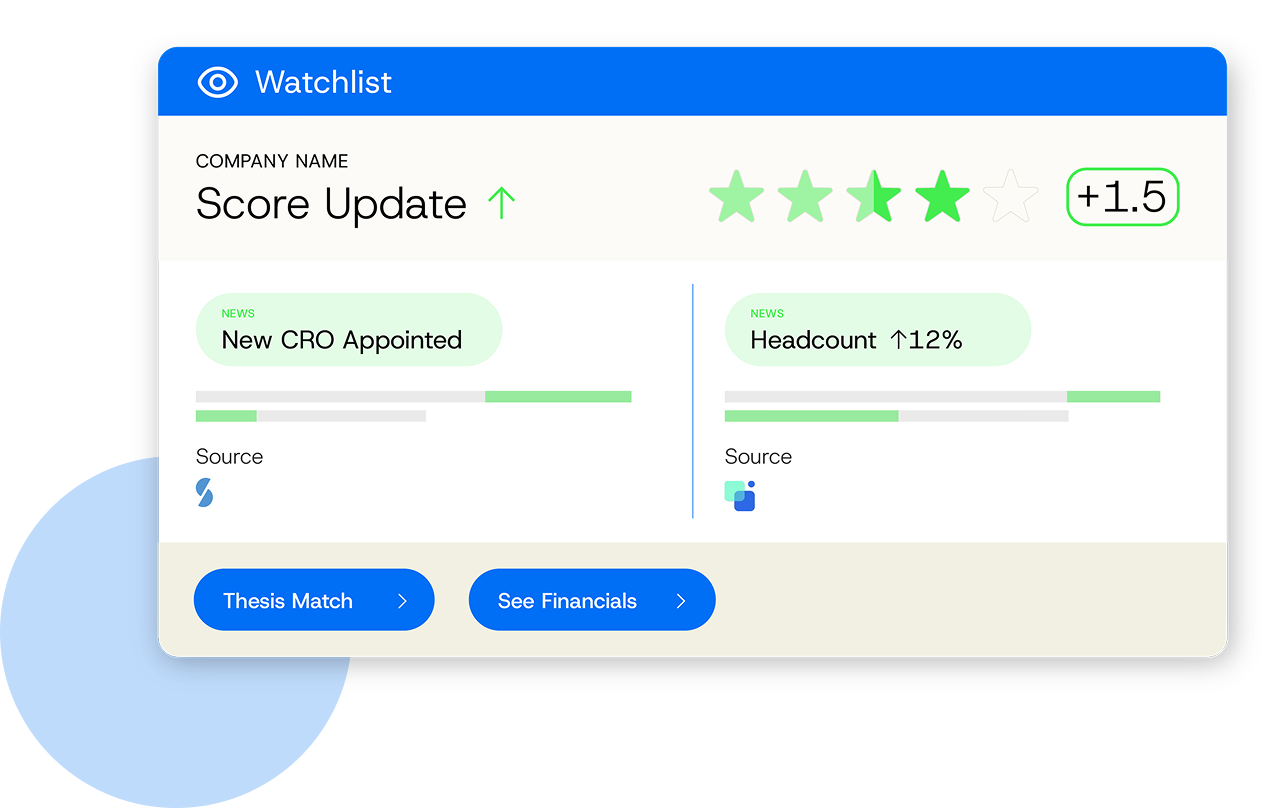

Empower origination teams with codified scoring, net-new recommendations, watchlists and tracked deals.

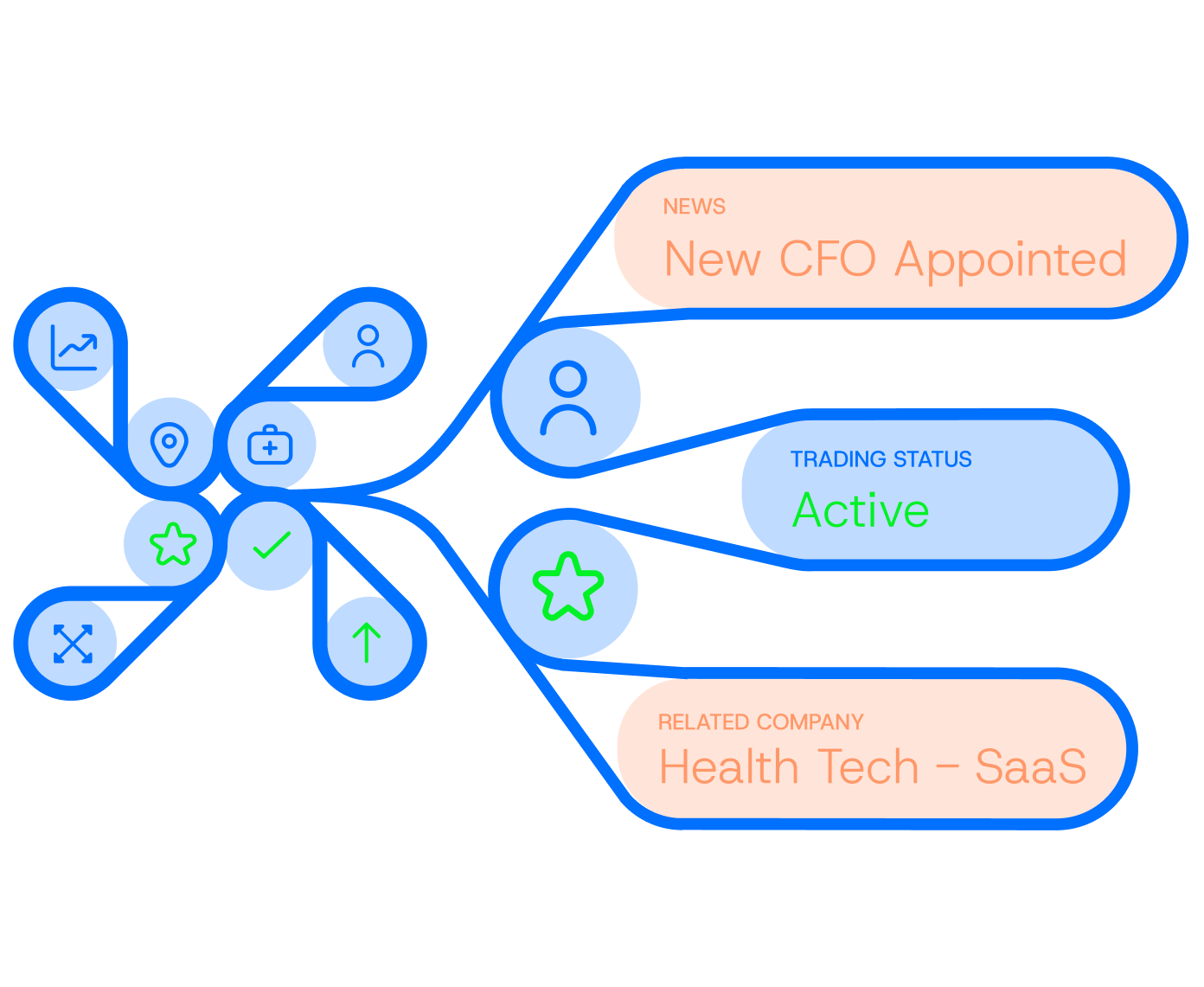

Connecting the unconnected in dealmaking

Unifying the data, intelligence, and signals that exist for private equity firms, and transforming it into deals.

Finally, a platform your firm can truly customize

Deal Engine is offered as a white-labelled solution, resulting in faster onboarding, adoption, brand alignment and organizational buy-in.

Expand the firm's funnel

Deal Engine delivers always-on intelligence that continuously monitors your entire investable universe — specified by your thesis — and surfaces high-fit targets.

Unify data, unlock insights

Deal Engine brings together proprietary, third-party, and public data into a single connected layer, transforming information into actionable intelligence.

Power up instead of piling on

Deal Engine enriches your CRM with structured, intelligent data without adding clutter, complimenting your existing tech stack instead of complicating it.

Build the AI-enabled firm of tomorrow

Accumulate and train your firm’s own proprietary data engine, built to evolve with your strategy and scale firm-wide tech-readiness.

Enabling firms to create their own edge

45M+

datapoints accumulated in a typical deployment

161

actionable insights per firm per month, on average

64

new deals on the radar in 2 months, on average

99.5%

decreased analyst time spent on manual research

.png)

Deal Engine Ushers in a New Data Engine Category for Private Equity

Rebranding from Filament Syfter, the firm’s new name and identity reflect its role in enabling every firm to unify their proprietary internal data and external market data into a single source of firm-wide market intelligence.

Turning Private Markets Data Into Decision-Grade Intelligence

Turning Private Markets Data Into Decision-Grade Intelligence In its latest private markets report, the Citi Institute makes one conclusion abundantly clear: data, AI, and digitalization are no longer optional enhancements — they are the primary sources of competitive edge for private equity firms navigating an increasingly complex investment landscape.

Private equity’s tech mandate is clear

Private equity’s tech mandate is clear: Run faster, build smarter, and choose AI partners carefully

How modern data engines are changing the rules of private equity

How modern data engines are changing the rules of private equity Private equity and corporate finance have spent the last decade layering on CRMs, datasets and dashboards, yet many teams still struggle to see a single, joined-up view of their market. In our recent data engines webinar, VP of Growth Alex Bajdechi noted that firms are now juggling “Expert network data, company data, fundraising data, proprietary data sitting across Excel data rooms” without a coherent way to connect it all.

Be first to every deal.

See Deal Engine in action.

Discover how Deal Engine is providing private equity firms with the data engineering and AI capabilities fueling their competitive advantage.